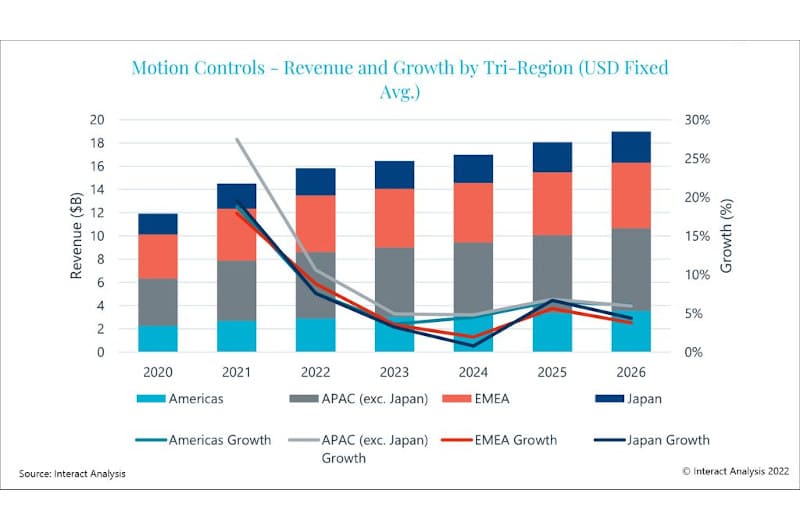

New research from Interact Analysis shows that strong 2021 growth in the motion controls market will be followed up with 9.1% growth in 2022. This growth will continue out to 2026, but at a slower pace with a CAGR of 5.5%. Meanwhile, global supply chain shortages, particularly issues in the semiconductor market and raw material costs, have resulted in major price increases from motion control suppliers.

The largest machinery market for motion controls in 2021 was metal cutting machine tools, while the sector set to post the strongest growth in demand for motion controls out to 2026 is mobile robots, with a CAGR of 52%. From a regional perspective, Asia Pacific (APAC) was by far the fastest growing, with a 2021 growth rate of 24.7% resulting in a market worth $5.17 billion.

China alone accounted for 36% of global motion control revenues in 2021 and, by 2026, China is predicted to hit $5.33 billion – larger than the entire APAC market in 2021. The lowest growth region in 2021 was Japan with motion control sales reaching $2.16 billion. EMEA fell in the middle, accounting for 31% of global revenues in 2021, while the Americas reported a sales revenue of around $3 billion.

In line with the growth outlook, motion control suppliers in the APAC regions, such as Mitsubishi Electric, Fanuc, and Yaskawa have performed better than those in the EMEA and Americas regions. The top 10 suppliers retained a combined market share of 65% in 2021. As a result of supply chain constraints and rising raw material costs, the average selling price of motion controls increased by 4.6% in APAC regions in 2021. In the EMEA and Americas regions, average selling prices rose by 6% and 7% respectively. Rising prices will continue throughout 2022.

Tim Dawson, Senior Research Director at Interact Analysis says: “COVID-19 has had and will have both positive and negative effects on the motion controls market. In 2020/2021, the pandemic created significant demand for automation which significantly boosted the outlook for the manufacturing industry. On the other hand, the pandemic hampered the short-term growth of the motion controls market due to workplace closures and restrictions, as well as supply chain issues. To meet demand, suppliers were forced to focus on production rather than R&D. This will have a knock-on effect on future growth. Labor shortages have in particular been a double-edged sword for motion control vendors. On the one hand, labor shortages have created a need for automation products, on the other, they have left automation vendors themselves struggling to meet demand due to a shortage of skilled staff.”

About the Report:

The 3rd edition of the highly-regarded Interact Analysis motion controls report provides an understanding of market and economic trends driving and restricting growth of motion controls in both general motion control (GMC) and computer numerical control (CNC) applications.

The report is built through extensive primary research and supplier reporting and utilizes data from Interact Analysis’ “Manufacturing Industry Output Tracker (MIO)” – well respected for its credible industry forecasts by country, which inform the forecast for motion controls. Analyzing over 800,000 unique data points, the sheer size of the data ensures consistency and reliability when interpreting forecasts.

About Interact Analysis:

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth.