“The monthly VDMA order intake and turnover statistics show that the order books of the machine vision industry are full to the brim. The demand for machine vision components and systems remain very high, however, companies are struggling to keep up with production due to the shortage of materials especially electronic components and therefore are having to reduce their current production plans,” says Mark Williamson, Chairman of the Board of VDMA Machine Vision, on the occasion of the opening of the VISION 2021 trade fair. “VDMA Machine Vision is therefore sticking to its forecast of 7 percent growth in turnover for the European industry for the current year and expect further growth of 7 percent in 2022, according to the latest VDMA survey.”

Machine Vision – a growth industry

In 2020, the turnover of the European machine vision industry fell by 4 percent compared to the previous year due to Corona. This was mainly due to weakening demand in Europe and the global automotive, pharmaceutical, metal, plastics, and rubber industries. Nevertheless, this was a very good result compared to other areas of the mechanical engineering industry. The growth prospects for the coming years remain strong with the trend towards “seeing machines” continuing over a number of years. Machine vision has established itself as a key component in the global race towards automation.

Non-industrial applications on the rise

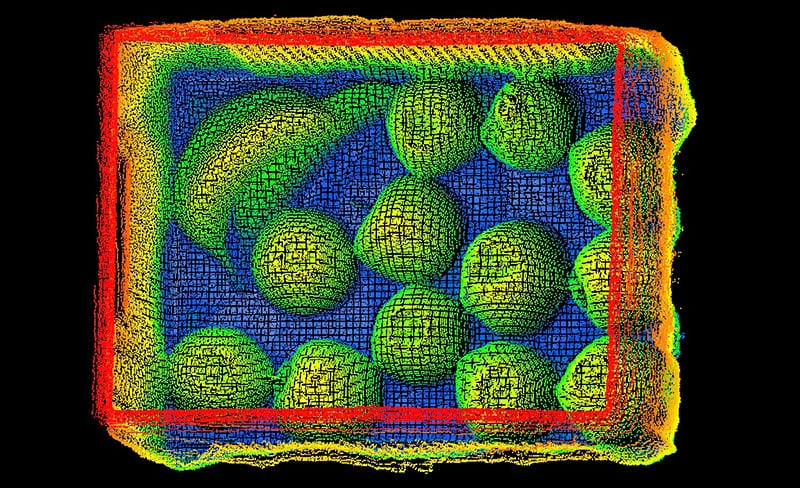

Machine vision is constantly conquering new sales markets and fields of application. In 2020, the share of the European machine vision industry’s turnover in sectors outside the factory floor, such as medical technology, security, agriculture, intelligent traffic systems as well as retail, was already 35 percent, and turnover there grew by 9 percent. Embedded vision in combination with artificial intelligence will set new growth stimuli.

Strong demand from the electronics industry

In 2020, the European machine vision industry’s turnover with the electronics industry (excluding semiconductors) increased by 20 percent and turnover with the semiconductor industry growing by 10 percent. Turnover within the automotive industry – otherwise the strongest customer of the machine vision industry – fell by 13 percent. The share of total turnover thus only accounted for 16 percent. Turnover within the food and beverage industry stagnated.

Asia as a growth driver

Europe remains an important sales market: 52 percent of the turnover of the European machine vision industry was achieved in Europe in 2020, 6 percent less than in the previous year while exports to Asia increased by 3 percent. Turnover in China grew by 10 percent and exports to America increased by 5 percent.

Record sales of cameras

Sales of machine vision components fell by 2 percent overall in the Covid-19-year 2020. Industrial cameras were the exception with a share of 27 percent of the total turnover of the European machine vision industry and recorded a 4 percent increase in turnover. The turnover of machine vision systems, on the other hand, fell by 3 percent.

Chip shortage burdens the industry

Many companies are struggling with increasing material and supply bottlenecks. In the VDMA flash survey at the beginning of September, 81 percent of mechanical engineering companies from all branches mentioned noticeable or serious impairments in their supply chains. Shortages of electronic components in particular have increased dramatically. Additional surveys among the membership of the VDMA Machine Vision sector group show the machine vision industry is not exempt from this challenge. There is virtually no company not suffering from the chip shortage including component manufacturers as well as system integrators with the situation worsening in the last three months and no improvement expected in the next three months. As a result, companies in the machine vision industry are having to cut back on their production plans with delivery of products being delayed. Impairments are also being felt on the demand side, as customers and their customers are in turn affected by the shortage of materials stalling the entire value chain. Despite a multi-layered shortage of materials, in customer industries, the demand for machine vision is not affected. Machine vision remains in high demand not only in and around factories worldwide, but also in new areas and applications.