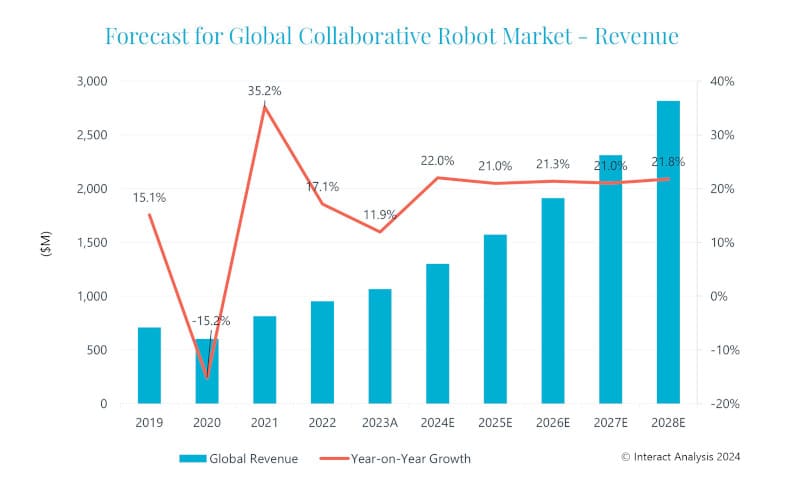

According to a newly released report by Interact Analysis, Collaborative Robot Market – 2024, the collaborative robot (cobot) market revenues will grow by 11.9% to $1.07 billion in 2023, reaching $1 billion. However, the growth rate will reach a new low after the pandemic.

From 2022 to 2024, it was observed that the sales of collaborative robots will change in a small “V-shape”. After hitting the bottom in 2020, the collaborative robot market made a remarkable recovery in 2021, growing by more than 35% over the market size in 2019, but the worsening economic situation and supply chain issues caused the market to stagnate under severe pressure in 2022 and 2023, driving the market. The growth rate will reach a new low after COVID-19 in 2023. Market: The outlook remains optimistic for the medium to long term, and price declines are slowing.

The pandemic has revealed the downside of the reliance on labor in manufacturing and accelerated automation improvements in logistics and services to make companies more resilient to possible future crises. This will have a long-term positive impact on the entire robotics industry, resulting in revenue increases of up to 20% on average over the forecast period (2024-2028).

The average market price of collaborative robots increased slightly in 2023. This is mainly due to the significant increase in shipments of larger payload models (especially in the group above 20 kg) in the fourth quarter of 2023, and the increase in demand for higher payload models is expected to further increase during the forecast period. In the latest forecast, the average market price is expected to increase by 4.4% by 2028 compared to 2023.

However, it is clear that the driving force behind the overall price decline is cost reductions due to economies of scale and mature industrial supply chains. The Chinese market, which accounts for more than half of the world’s supply, continues to experience significant price declines. Note that in the curve below, economy models priced below $5,000 have been removed. At the same time, the emergence of some large cobot orders (over 100 units) contributed to price declines. According to our research, some orders for over 100 EVs are trading for less than $6,000.

Products: From generic to segmented models

The development of collaborative robots is gradually shifting from generic products to segmented models for specific application scenarios. This trend reflects the growing market demand for more specialized collaborative robots across various industries. Below are some factors influencing the development of these specialized collaborative robots:

Diversification of load capacity and workspace: The load capacity and workspace of a collaborative robot are key parameters in its design. Robot manufacturers offer products with different load capacities and working ranges to suit different application requirements. For example, a lightweight collaborative robot is suitable for light assembly and handling tasks, while a heavy robot is suitable for heavier material handling tasks.

Application-specific optimization: Some collaborative robots are designed for specific application scenarios, such as: B. Laboratory automation, medical surgery support, education and scientific research. These robots usually have special features that suit their application scenarios, such as: B. High precision, special end effectors, or safety features that meet industry standards.

Technology integration and innovation: As collaborative robots develop, more advanced technologies such as artificial intelligence, machine vision, and force feedback control are integrated to meet the needs of specific market segments. The application of these technologies allows collaborative robots to work more effectively with human workers and perform more complex tasks.

Customers: Increasing direct sales and collaboration with customers

The sales channels for collaborative robots are divided into direct sales and distribution networks (through agents and system integrators). As most of the customers are small and medium-sized enterprises, distribution networks contributed to more than 90% of the total market sales until 2020. Direct sales mainly target large customers in major industries. However, because the robot market is widespread and geographically distributed, relying solely on direct sales is not enough to meet the needs of users. Distributors are usually system integrators with technical backgrounds, who provide automation solutions combined with robots to customers in various industries.

The distribution model can quickly build a distribution network to capture the market. However, it is also important for robot manufacturers to ensure that they do not overly rely on the sales and technical support capabilities of distributors and have a clear understanding of the true needs of downstream customers. In order to build deeper connections with customers and understand the needs of practical application, the proportion of direct sales has increased significantly in recent years. For robot manufacturers, working with customers to develop various scenarios and use cases has become an important trend. Through direct sales, robot manufacturers can provide the right solution based on the specific needs of their customers, find the right application for collaborative robots in specific scenarios, and work with customers to find the best way to use collaborative robots. By working closely with customers, robot manufacturers can also improve customer retention and loyalty.

For different application scenarios, there are more suitable semi-customized products and secondary development activities that can be performed. These methods include:

- Providing process packages that support rapid deployment and customization to specific application scenarios. Users can select and configure kits according to their needs to create their own system.

- Provide a variety of secondary development interface solutions that can quickly respond to customized needs in various industries.

- Launch various semi-custom products according to application categories.

The future is bright for the expanding collaborative robot market

When analyzing the global collaborative robot market from every angle, it is clear that there are signs of change and growth. We expect the market to continue to grow and adapt to changing customer needs and global events.

As collaborative robots become smarter and can carry larger payloads, price declines are expected to slow and deliveries are expected to increase significantly through 2028 and beyond. Currently, logistics applications lead the market, but growth is also expected in non-industrial sectors and areas such as welding, where the market potential has not yet been fully realized.

To realize the full potential of this growth, collaborative robot manufacturers need to listen carefully to their customers’ needs, develop new application scenarios, and at the same time work with distributors to build their sales network