A new ROI calculator from OMRON has been launched to support the process of evaluating an investment in collaborative and mobile robots, including easy and affordable leasing opportunities that are ideal for small and medium enterprises (SMEs).

OMRON’s ROI calculator gives companies who are considering investing in collaborative or mobile robots a quick and easy overview of the return on investment based on actual data. It allows users to estimate the number of months it will take for an investment to break even, whilst accounting inflation and interest rates adjustments according to the market conditions.

Mobile robots and cobots are easy to deploy and are transportable, making them an advantageous companion to achieve greater flexibility in production. They can also provide a safer working environment, working alongside their human colleagues to assist in handling or transporting goods and material.

However, many small and medium-sized enterprises (SMEs) cannot afford the upfront capital investment of such technologies. OMRON provides leasing options that are designed to make life easier for manufacturers who want to develop their fleets of mobile robots or collaborative robots (cobots) whilst keeping their initial capital investment costs low.

Eduardo de Robbio, OMRON’s Strategic Business Development Manager comments: “We have seen an increase in the need for high-mix low-volume production during the pandemic, combined with a shortage of workers in many industries. This has led to more vacancies both for human operators and robots. In addition to flexible leasing options, we wanted to provide an easy-to-use ROI calculator tool for our customers to support their decision-making process.”

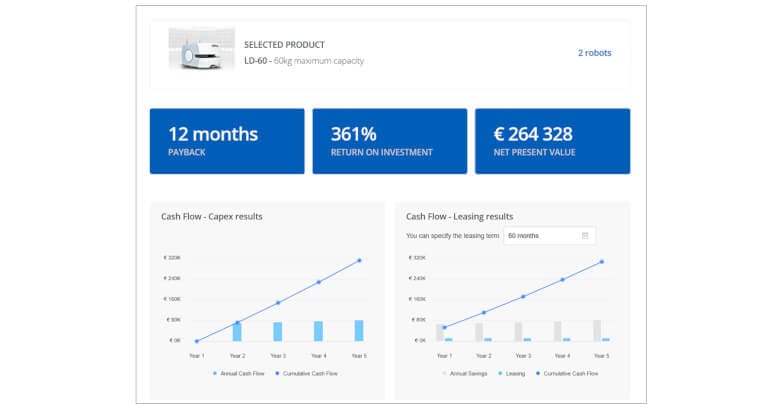

Once data is entered regarding the current operations, and the type and number of robots is selected, the ROI calculator gives a clear overview of the payback period, ROI percentage as well as the net present value (NPV), which shows the estimated current total value of the future cash flows.

A key decision for the customer is how to finance a new investment. The ROI calculator from OMRON gives two typical options: the traditional Capex option with full payment at the beginning and an Opex option with leasing, with payments spread between 3-5 years.

De Robbio continues: “Robots can take care of repetitive tasks, and ensure flexible, accurate and efficient operations, allowing human colleagues to focus on business-critical issues and creative tasks. Regarding the fundamental aspect of ROI, human labour is assigned to more value-added tasks, which is absolutely essential for manufacturers going forward. Furthermore, automation can balance the gap of experts in the labour market.”